Photo by Alice Pasqual on Unsplash

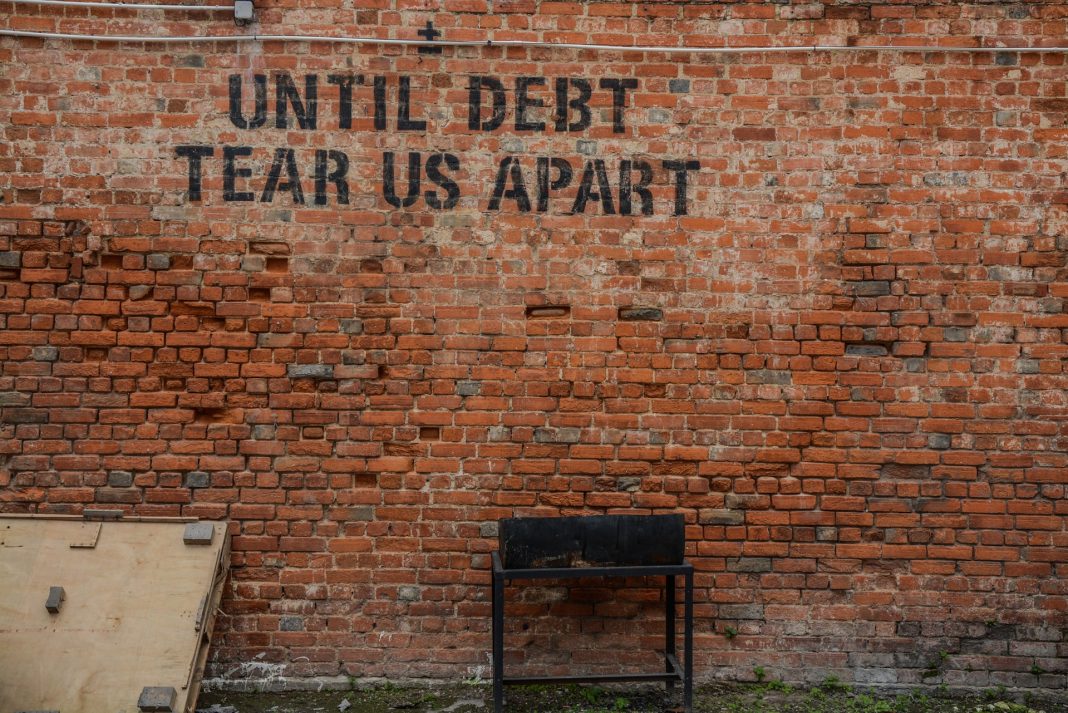

There is manageable debt, and then there is crippling debt. It would appear that law school debt is the latter for many graduates. It’s like the proverbial albatross around their neck, a recent survey showed.

Many are avoiding taking on more financial stress and delaying marriage, home buying and having children. They’re also compromising career choices.

Done by the American Bar Association Young Lawyers Division (YLD) and the AccessLex Institute, the survey found that 65% of grads felt their debt was causing them to feel anxious or stressed, and a little over half reported it has caused them to feel regret or guilt. Not surprisingly, the angst was higher when debt was higher.

A majority of those with more than $100,000 in debt agreed that their loan obligation has caused them to feel depressed or hopeless.

Not many escape law school without debt, either. About 90% of respondents had to borrow, owing an average of $108,000 in J.D. loans and $130,000 in all loans combined at graduation.

For Black graduates, the situation was even grimmer. No other ethic group had higher debt totals, the survey found. Black graduates were also the most likely to report that their debt was higher at the time of the survey than at graduation.

The implications are far-reaching and life-altering. “An overwhelming majority of borrowers — roughly 80% — indicated their debt influenced their choice of job or career in some way,” according to the survey, Student Debt: The Holistic Impact on Today’s Young Lawyer.

This was the second such survey done by the YLD. The first was done in Spring 2020. This latest one was performed in May 2021, with 1,300 lawyers under the age of 36 participating.

The first survey produced similar results. This one set out to dig deeper and “provide more nuanced understanding of the impact of student loan borrowing on the career trajectory of young lawyers.”

Young lawyers complain on a host of internet forums about law school debt and how it can be overwhelming:

“It’s hard to breathe … and even though I have a high income, too, the more I make my student loan payment just goes up proportionally — so it’s like I can’t get ahead,” wrote a lawyer on the financial website, You Need a Budget, YNAB.

One law school grad told CNN Money of his unconventional way of knocking out his debt: he joined the Army. “I paid off $108,000 of law school loan debt,” he said. “All I had to do was put my life on the line.”

Many people are making significant sacrifices. It’s not just a handful.

Photo by Elisa Ventur on Unsplash

Again, from the report: “Most young lawyers who borrowed for their education report their debt has caused them to delay or forego pursuit of traditional life milestones that were commonplace in the past, such as purchasing a home, marriage, and starting a family.”

To help prospective students avoid financial risks is one of the reasons preLaw magazine produces its yearly analysis, Best Value Law Schools, which will be published in our upcoming fall edition. Two of the key metrics are tuition costs and debt.

Deans from the top-ranking schools consistently note the importance of keeping debt low so students can pursue the kinds of careers they want and tackle their law careers without the added stress of making rent.

Making wise financial choices may be more important in today’s environment. Law school enrollment — after years of falling — has been on the upswing. However, it’s unknown if the job market will be able to absorb the growing number of newly minted lawyers coming through the pipeline.

There was at least one encouraging finding:

“Although a majority of respondents reported they lacked a clear understanding of the legal job market and the cost/debt associated with law school attendance prior to enrolling, 61% reported they would still pursue a J.D. if they could do it again and 55% would attend the same law school.”

The report stressed the importance of reform.

“These results demonstrate the need for greater understanding and improvement upon the career, financial, and well-being outcomes of law students and graduates who seek loans to finance their legal education,” the report said.

The report suggests a number of actions, including:

- Expand access to, and awareness of, free financial and mental health resources for recent law graduates and early career attorneys.

- Improve financial literacy and awareness of the legal job market and the cost of law school attendance among pre-law and current law students.

- Improve the Public Service Loan Forgiveness Program to provide a more transparent and seamless process for those seeking to maintain eligibility.

- Reform the federal student aid programs to make loan repayment more manageable for borrowers.

- Improve consumer information available to pre-law students.